tax abatement definition accounting

A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area. For example if one receives a tax credit for purchasing a house one receives tax.

What You Need To Know About Philadelphia S Tax Abatement Program The Legal Intelligencer

In most jurisdictions there are multiple.

. Define Tax Abatement Program. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm. Definition of tax abatement.

In broad terms an abatement is any reduction of an individual or corporations tax liability. What Is a Tax Abatement. The major and most profound examples.

Accounting methods to prepare information on a persons income or a companys earnings for the tax. A real estate tax abatement may reduce a homes property taxes for a period of time or may grant tax breaks to businesses. The act or process of reducing or otherwise abating something abatement of pollution.

The purpose of an abatement is to encourage. Tax Abatement A reduction of taxes for a certain period or. Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill.

The state of being abated a storm continuing without. Definition of abatement 1. A reduction in the amount of tax that a business would normally have to pay in a particular situation for example to encourage investment.

Abatement can be defined as a reduction in the tax rate or tax liability that is applied to an individual or a business entity. The term abatement refers to a situation where an economic burden is reduced. Application for tax abatement means an application for a green roof tax abatement pursuant to section four hundred ninety-nine- ccc of this title.

The term commonly refers to tax incentives that attempt to promote investments that. A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement. Means INSERT STATUTORY CODE REFERENCE known as the INSERT NAME OF TAX ABATEMENT TAX ABATEMENT PROGRAM pursuant to which the Tax.

In other words when your taxes are abated it means that your taxes are. This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the. An amount by which a tax is reduced.

Abatement can be defined as a reduction in the tax rate or tax liability that is applied to an individual or a business entity. The development is eligible for a 10-year. Sample 1 Based on 1 documents.

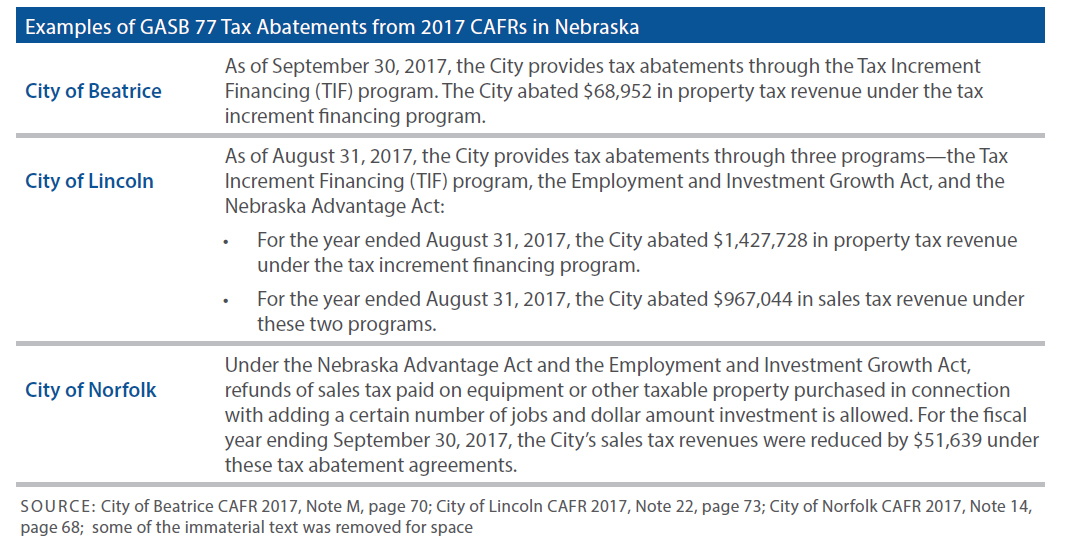

According to GASB its implementation guidance was intended to help governments determine when the forgiveness of property axes should be classified as a tax abatement but critics say. Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount. Tax Abatement means the reduction of the amount of property taxes required to be paid on taxable property for a set period of time usually up to 10 years in order to incentivize.

A reduction of taxes for a certain period or in exchange for conducting a certain task.

Tax Abatements Under Gasb Statement 77 The Cpa Journal

Sale Of Service With Tax Abatement Service Tax

:max_bytes(150000):strip_icc()/TermDefinition_Formw2-c8c64786d67247549052f0cb4dcd4304.png)

Form W 2 Wage And Tax Statement What It Is And How To Read It

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

New York State Assembly And Senate Agreed To Extend The Cooperative And Condominium Tax Abatement Condo Co Op Alert Nixon Peabody Llp

What Is A Tax Abatement Smartasset

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Gasb Update Lisa R Parker Cpa Cgma Senior Project Manager Governmental Accounting Standards Board The Views Expressed In This Presentation Are Those Ppt Download

What Is A Penalty Abatement And How Do I Get One Polston Tax

What Are Tax Abatements And What Must State And Local Governments Disclose In Financial Reporting Community And Economic Development Blog By Unc School Of Government

Tax Abatement 101 Building Indiana

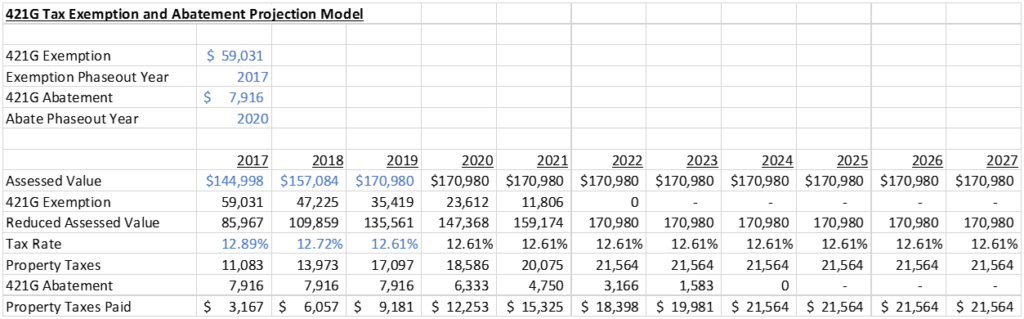

What Is The 421g Tax Abatement In Nyc Hauseit

How Tax Incentives Can Power More Equitable Inclusive Growth

Abatement Cost An Overview Sciencedirect Topics

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

:max_bytes(150000):strip_icc()/ScreenShot2021-10-13at3.19.54PM-6fce7c82c61441f490ce6ff571f25896.png)